About Me

Hi there! 👋

I’m Ying Chai, a graduate student at Robert H. Smith School of Business, University of Maryland, majoring in Business Analytics.

For several years, I’ve been having a passion for data science and it has guided my academics and career path. I have three prior experiences so far with data science related internships, and the most recent one is working as a Data Analyst Intern in Xiaomi Technology in Beijing. Currently in graduate school, I’ve taken a variety of related courses including Database Management, Machine Learning, Data Visualization, etc., done several projects, and grown a better understanding of the analytical skills required in workplace, along with the business knowledge to excel my work.

Download my resumé.

- Data Science & Machine Learning

- Financial Risk Management

- Business Analytics

MS in Business Analytics, 2022

University of Maryland, Robert H. Smith School of Business, USA

BS in Finance, 2021

Guangxi University, China

Exchange Program in Finance, 2019

Missouri State University, USA

Skills

Tidyverse, ggplot

Pandas, Scikit-learn, Seaborn

Advanced query, Data pipelines

Dashboard, Data Story, Web Analytics

Pivot Table, V-Lookup, Solver

Statistical Models, A/B Testing

Data Visualization

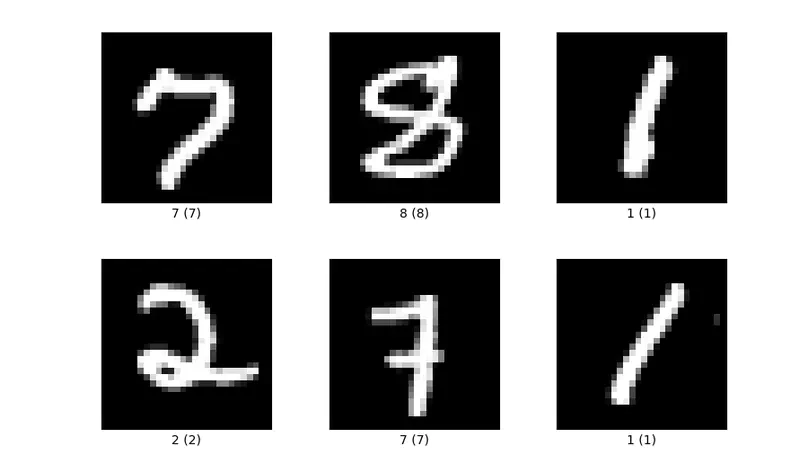

Logistic Regression, Random Forest, XGBoost

Experience

Produced 10+ market research reports to analyze online video & streaming media industry and competitors to support decision making.

Selected metrics, created and maintained 5+ visualization dashboards in Tableau by building data pipelines connected to SQL database to monitor daily users’ behaviors and product performance.

Preprocessed (cleaning, transforming, and checking) the data in Python, applied statistical models and machine learning algorithm using Pandas and Scikit-learn to conduct explanatory and predictive analysis, to understand the effective elements to the business.

Collaborated with product team to implement A/B testing to improve product features, increasing users’ engagement rate by 20% and premium member conversion rate by 15%.

Automatically scraped financial data using Python Beautiful soup, eliminating redundancy and improving efficiency by 75%.

Conducted exploratory and explanatory analysis in Excel (pivot table and advanced functions) and Python (pandas) to the bond market data, and analyzed 5+ municipal bonds to predict the risks and future returns.

Tracked and predicted securities market trends of different industries and stock price trend of firms to support investment assessment.

Provided consultations for 100+ clients and developed potential clients by offering tailored financial portfolio products and maximizing clients’ financial benefits.

Explored sales and consumers data of financial management products using linear regression model in SPSS, and targeted customers in different areas to increase sales by 10% MoM.

Conducted cluster analysis in Excel to identify potential clients, increasing deposits by $20K.

Projects

Contact

Hey, thanks for making it through here, I appreciate your time! Feel free to reach out to me through Linkedin/Email to hire me/team up for projects!

- ying.chai@marylandsmith.umd.edu

- +1 (202)577-2679

- College Park, MD 20740